Investing for the ‘Vibeflation’?

Last quarter, we talked about the ‘Vibecession’ – the disconnect between how people feel the economy is going and how it’s actually going.

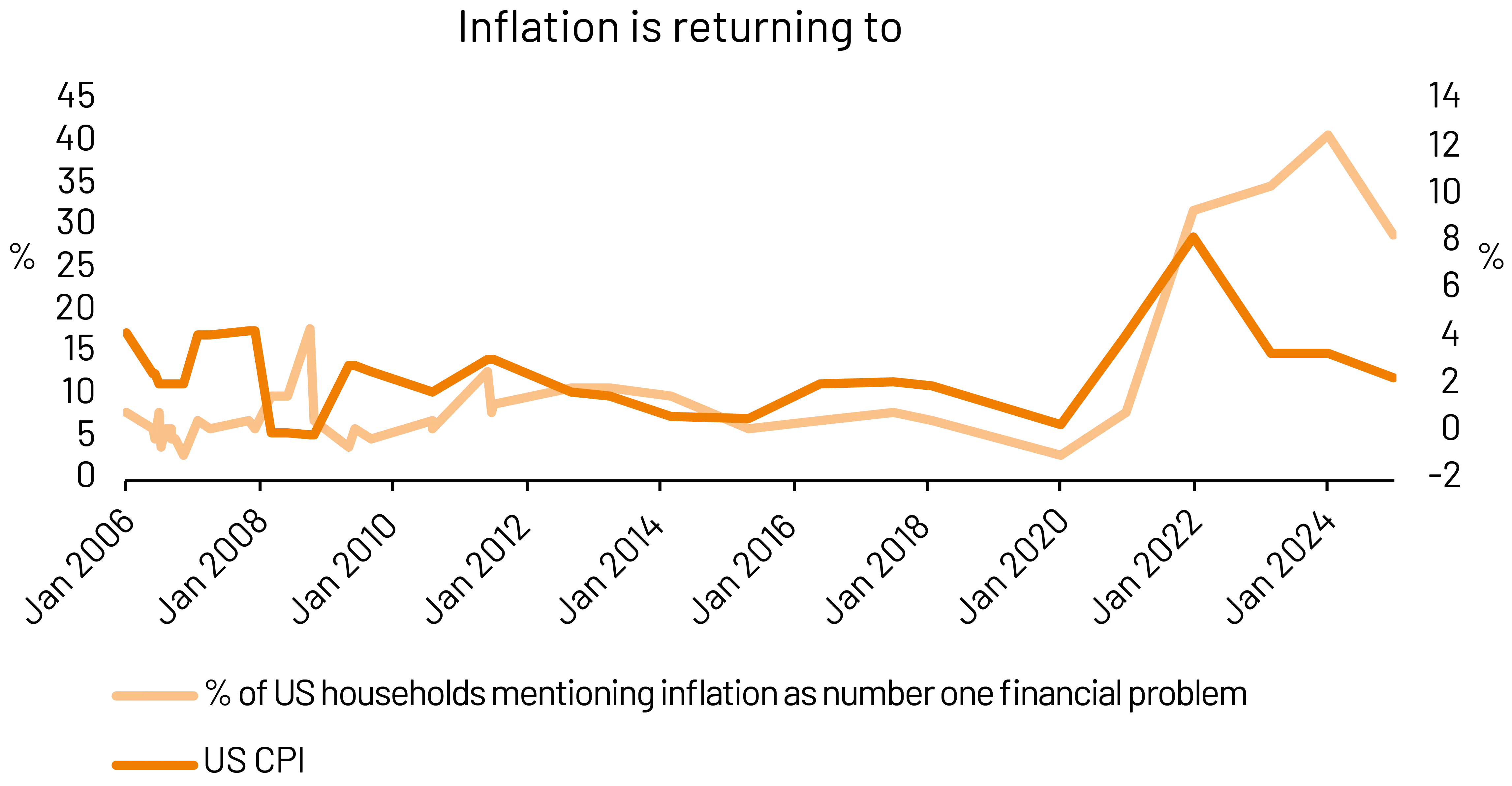

‘Vibeflation’ doesn’t quite have the same ring to it, but it turns out there is also a disconnect between the actual rate of inflation and where people think prices are.

This summer TikTok trends have narrowed their focus on inflation. Millennial and Gen Z influencers reminiscing about the days of stable prices are now shocked at $8 cereal boxes or sky-rocketing egg prices. As one influencer put it, “inflation is inflationing.” Wise words.

The disconnect comes with how we look at the data. The actual numbers would suggest things are getting better. Inflation rates are down from where they were post COVID and close to the Federal Reserve’s long-term target of 2%. But people don’t view prices in terms of year-on-year growth. They think of prices as cumulative. Something that used to cost “around a fiver,” now costs “around a tenner.” Reframe it this way and we find that the total inflation basket in the US is up 25% in the last five years. Having no inflation for a year doesn’t feel that helpful, because prices are still 25% higher.

So maybe the influencers are onto something. In the real world, household surveys continuously find inflation at the top of household concerns (see Callout.)1 And closer to home, the inflation vibes are just as negative. Not helped by UK bond yields drifting higher this year, this is prompting concerns on how this inflation anxiety is going to play out in markets.

Inflation leaves scars

First, let’s unpick the inflation anxiety. Behavioural economist Ulrike Malmendier is a leading researcher into the psychological impacts of economic crises and finds that inflation, in particular, leaves a lasting scar2.

There are three main way these scars come about. First, even though inflation refers to a big basket of goods and services, consumers tend to focus on key items important to them, like energy bills and groceries… people don’t tend to get too emotional about their home insurance inflation.

The last State of the Union address even had a notable mention of egg prices.3

Second, the items we tend to focus on happen to be the most volatile of them all. In any given year, eggs, energy or wheat prices can have big fluctuations if bird flu hits, war breaks out or freak weather occurs. While economists use ‘Core CPI’ to strip out food and energy, to look at underlying trends, the rest of us don’t think like economists.

Third, it would be fine to focus on volatile prices if we focused on the ups AND the downs. But it turns out, we disproportionately focus on the worst outcomes. There aren’t many TikTok trends about how pleasantly surprised people are about how well-priced everything is.4

The UK - scars from the 1970s

While the inflation scars are still with us, there are some positive signs. Wage demands are settling down, oil prices are lower this year than last, and milk prices are steady, following a notable surge a few years ago.5 Inflation rates are close to targets in the US and Europe. And this is having real world consequences as central banks respond with lower rates.

However, the UK feels different. Inflation seems a little harder to dislodge and bond market yields are diverging from the US. And it feels like a never-ending story - one year it’s milk prices, the next year its car insurance and this year it’s air fares!6 Some are even comparing this to the 1970s... those inflation scars run deep.

There are plenty of issues that the UK will need to resolve, as noted by the independent Office for Budget Responsibility (OBR).7 However, we should remain balanced. While some have implied a 1970s balance of payments crisis is on the cards (with an IMF bailout), we think this is too far. Back then the UK economy was vulnerable to oil prices (where the OPEC shock saw oil prices rise three times), leading to the country running out of Dollars. This time around, the Bank of England is a lot more flexible and the trade deficit is more stable.

Markets scars don’t last as long

And it looks like markets agree. While UK bond yields have drifted higher than the US this year, the pound is also stronger vs the Dollar. Hardly panic stations.

Last quarter, we cautioned against allowing an overly pessimistic view of the economy impact investment choices. And we’d say the same about inflation.

Take UK Gilts as an example. Returns were severely impacted by the inflation surge post-COVID. Yields went from near-zero to over 4% (remember that bond prices and yields move in opposite directions). While those scars last with us as consumers, the market has already moved on. And the same applies to global bonds.

The simple reason is that prices are lower and bond yields are higher since then, so much so that the ‘real yield’ – the yield after you take account of inflation – is higher. Or put another way, since the inflation scare, the market has set yields to be significantly above long-term inflation. The result is that over the last three years, an investor in global bonds, which would include gilts, would have made double-digit returns. The markets aren’t so concerned about the Vibeflation.

And this feeds into all asset classes. Take the 7IM Moderately Cautious portfolio, where long-term guideline expected returns have gone up from 3.5% pa to 5.5% pa in the last three years. This is by no means a guarantee that returns will come immediately. But it is key that investors should ignore the vibes and make sure that while there is the risk of higher inflation, they’ve got their money working to deliver more than inflation rates.

While those inflation scars take time to heal, portfolio returns can be a soothing balm.

1 https://news.gallup.com/poll/660071/inflation-top-financial-problem-fewer-cite.aspx

2 https://www.richmondfed.org/publications/research/econ_focus/2024/q1_q2_interview

3 https://www.politico.com/live-updates/2025/03/04/trump-joint-address-to-congress/no-egg-price-fix-00212777

4 https://www.bundesbank.de/resource/

blob/837930/67120bc9074bd263e-ce0b0083ed6fcc5/mL/2022-06-23-elt-ville-keynote-2-malmendier-data.pdf

5 https://www.theguardian.com/environment/2022/mar/25/dairy-farmers-milk-production-inflation-prices-costs

6 https://www.bbc.co.uk/news/articles/c741wkngndqo

7 https://obr.uk/frs/fiscal-risks-and-sustainability-july-2025/

Inflation in the US, like in most other places, rose sharply and then fell just as sharply. The scars of this are still being felt by US households. When US families are asked about their biggest financial concerns, inflation is top of the list. While inflation rates have come down to pre-COVID levels, fears about inflation have not. The disconnect continues.

Source: Gallup, BLS, 7IM

More from 7IM

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.